In Africa, while paper remains the primary medium for invoice exchange in many regions, a digital revolution is gradually taking shape. Several countries across the continent are actively embracing e-invoicing and continuous transaction controls (CTC) as part of broader efforts to modernize business processes, enhance transparency, and boost tax collection efficiency. This shift towards digital invoicing reflects a growing recognition of the potential benefits of electronic systems in improving the efficiency and integrity of financial transactions in Africa.

However, the continent presents a diverse landscape in terms of e-invoicing adoption, timelines, and chosen standards. While some countries are making rapid progress in implementing e-invoicing systems, others are still in the early stages of adoption. Additionally, the timelines for implementation vary significantly, with some nations moving swiftly towards digitalization while others are taking a more gradual approach. Likewise, the standards and regulations governing e-invoicing differ from country to country, further contributing to the complexity of the e-invoicing landscape across Africa.

Eastern Africa: Frontrunners in Digital Transformation

- Burundi

- Djibouti

- Eritrea

- Ethiopia

- Kenya

- Rwanda

- Somalia

- South Sudan

- Tanzania

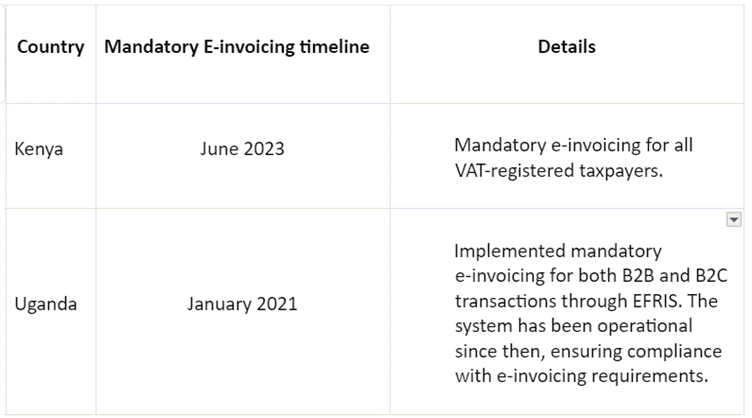

- UgandaGovernment’s stance: Eastern Africa emerges as a leader in e-invoicing adoption, with several countries implementing mandatory requirements for specific taxpayer segments.

- Timelines and deadlines:

E-invoicing standards:

Southern Africa: Taking Cautious Steps Towards Digitalization

- Botswana

- Eswatini

- Lesotho

- Malawi

- Mozambique

- Namibia

- South Africa

- Zambia

- Zimbabwe

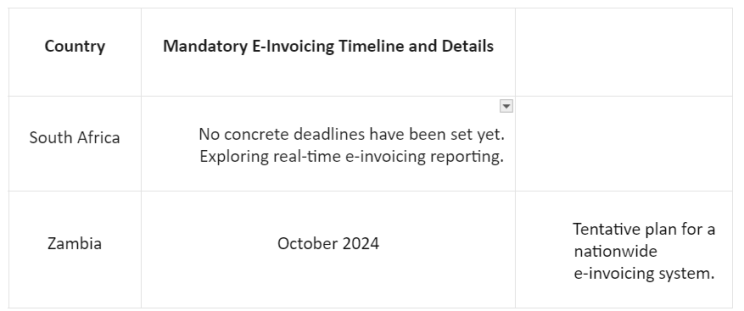

Government’s stance: In Southern Africa, the cautious approach to e-invoicing is influenced by several factors. Challenges related to inadequate digital infrastructure, including limited internet connectivity and outdated technology, pose significant barriers to widespread adoption. Developing a robust regulatory framework is essential, requiring clear legal frameworks, compliance requirements, and data protection regulations. Capacity building efforts are necessary to equip businesses and government agencies with the skills needed for a smooth transition. Additionally, concerns about the initial setup costs and financial implications of e-invoicing implementation contribute to the cautious approach. Despite recognizing the potential benefits, such as increased efficiency and cost savings, Southern Africa is proceeding cautiously to address these challenges and ensure a sustainable transition to digitalization.

Timelines and deadlines:

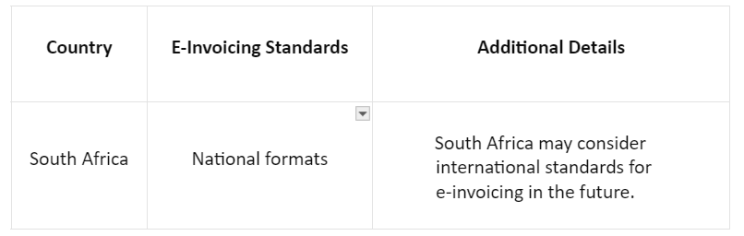

E-invoicing standards:

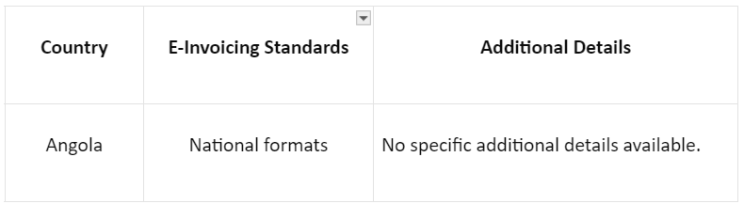

Businesses affected: In South Africa, mandatory e-invoicing is not yet implemented, so, it wouldn’t apply to businesses currently. In Angola, e-invoicing is voluntary for businesses, but those utilizing certified software gain benefits like simplified VAT reporting.

Western Africa: Early Stages of Exploration

- Benin

- Burkina Faso

- Cape Verde

- The Gambia

- Ghana

- Guinea

- Guinea-Bissau

- Ivory Coast

- Liberia

- Mali

- Mauritania

- Niger

- Nigeria

- Senegal

- Sierra Leone

- Togo

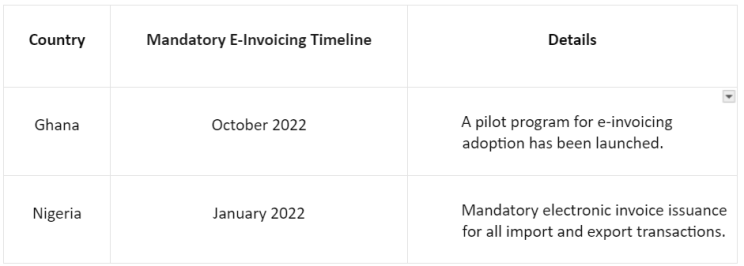

Government’s stance: Western Africa is in the early stages of e-invoicing adoption, with pilot programs and targeted initiatives.

Timelines and deadlines:

- E-invoicing standards: Mainly use national formats.

Businesses affected: In Ghana, only businesses involved in the pilot program are currently affected. In Nigeria, the mandate applies to businesses engaged in import/export activities.

Central Africa: Lagging in Digital Transformation

- Angola

- Cameroon

- Central African Republic

- Chad

- Congo

- Democratic Republic of the Congo

- Equatorial Guinea

- Gabon

- São Tomé and Príncipe

Government’s stance: Currently, Central African countries have not established concrete deadlines or standards for e-invoicing.

Timelines and deadlines:

E-invoicing standards:

- Businesses affected: E-invoicing mandates are not yet implemented in most Central African countries, so businesses are not currently affected.Northern Africa

- Algeria

- Egypt

- Libya

- Morocco

- Sudan

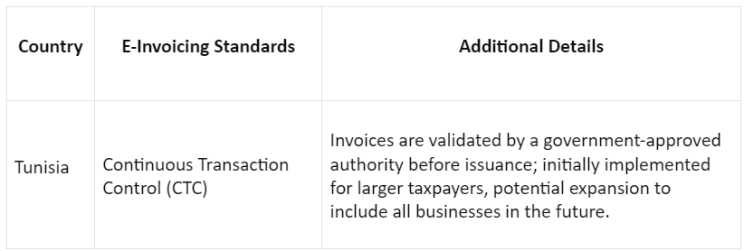

- Tunisia

- Western Sahara

Government’s stance: Across Northern Africa, governments have displayed varying levels of commitment to e-invoicing adoption. While Tunisia stands out as the sole country with mandatory e-invoicing, utilizing the Continuous Transaction Control (CTC) standard, other nations in the region have yet to enforce similar requirements. However, there is a growing recognition of the potential benefits of e-invoicing in enhancing transparency, efficiency, and tax collection processes, suggesting a possible trend toward broader adoption in the future.

Timelines and deadlines:

E-invoicing standards:

The remaining countries (Algeria, Egypt, Libya, Morocco, Sudan, Western Sahara) haven’t implemented mandatory e-invoicing yet.

Although there are talks about adopting e-invoicing systems in some of these countries, particularly Morocco, there are no concrete details or timelines available.

In Africa, the impact of e-invoicing on consumers varies across different regions. In Southern Africa, the impact on consumers is indirect, with the focus primarily on enhancing business processes and tax collection efficiency. Similarly, in Eastern Africa, the impact on consumers is also indirect, with e-invoicing aimed at improving transparency and reducing fraud in financial transactions. In Western Africa, there is limited impact on consumers at this stage, as e-invoicing implementation is still in its early stages. In Central Africa, the impact is not applicable due to the nascent stage of e-invoicing adoption in the region. Overall, while the immediate impact on consumers may be limited, the long-term benefits of e-invoicing, such as improved efficiency and transparency, are expected to have a positive effect on consumers across Africa.

The Challenge of Standardization: A Hurdle to Overcome

Despite the growing adoption of e-invoicing across Africa, a significant challenge persists in the absence of a standardized approach. The current landscape is characterized by a patchwork of national formats, proprietary standards, and limited use of international standards like PEPPOL. This lack of standardization hinders seamless cross-border trade and creates complexities in data exchange, impacting businesses operating in multiple African countries.

As Africa navigates the digital transformation journey with the adoption of e-invoicing, the continent faces both opportunities and challenges. While strides are being made to enhance business processes, improve transparency, and boost tax collection efficiency, the absence of standardized approaches presents a significant hurdle. Nonetheless, with countries in Eastern, Southern, Western, and Central Africa at various stages of e-invoicing implementation, there is a clear momentum towards embracing digital solutions. By addressing the challenges of standardization and fostering collaboration across borders, Africa can unlock the full potential of e-invoicing, driving economic growth and prosperity across the continent.

Reach out to us at hello@marmin.ai