In the realm of accounting software, Xero stands as a titan, offering robust solutions that cater to businesses worldwide. With its extensive features and capabilities, Xero empowers users to streamline their financial operations seamlessly. However, when it comes to navigating the complex landscape of KSA compliance, additional support becomes essential.

In this blog post, we will explore how Marmin bridges the gap between Xero’s global capabilities and the specific regulatory requirements in Saudi Arabia, offering businesses a seamless integration experience and ensuring compliance at every step.

Challenges and Limitations

The fact that Xero is not yet approved as an E-invoice Generating Solution General (EGS) in KSA presents some hurdles to businesses that are trying to adhere to the KSA e-invoicing guidelines. Some of the key challenges include:

- Constant Regulatory Changes: ZATCA frequently updates its regulations and requirements for e-invoicing systems to align with evolving tax laws and policies. Xero users must navigate these changes independently, which can be time-consuming and complex.

- Lack of Direct Integration: Xero’s current integration with ZATCA and other regulatory systems in Saudi Arabia has certain limitations. Users may need to implement manual workarounds or rely on third-party solutions to achieve compliance, adding complexity to their financial and business workflows.

Understanding and adhering to ZATCA’s compliance requirements is crucial for all businesses operating in the region. Businesses may face penalties, fines, or legal consequences if their invoicing processes do not meet the required standards set by the tax authority.

Marmin extends its support to businesses navigating both Phase 1 and Phase 2 compliance requirements. From standard invoices to export invoices and tax-exempt transactions, Marmin guarantees smooth synchronization and validation with ZATCA. Users can confidently depend on Marmin to meet specific compliance requirements, enhancing Xero’s global capabilities with specialized local expertise.

Integration with Marmin

Users can effortlessly link their Xero accounts to Marmin in just a few minutes. By inputting business and bank details and completing a straightforward click-to-connect process, Marmin seamlessly integrates with Xero. This smooth integration guarantees a user-friendly experience, reducing complexities and optimizing efficiency.

Here’s a step-by-step guide for the integration.

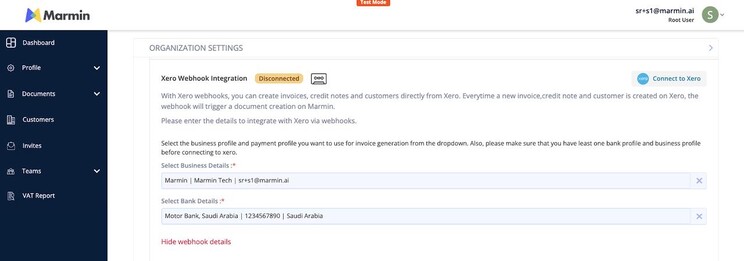

Select Business and Bank Details for Integration

When initiating the integration process, users are prompted to select their relevant business and bank details for seamless integration. This crucial step ensures the accurate recording and processing of financial transactions. Users must choose their preferred business and payment profiles from the drop-down menu for invoice generation. It’s important to have at least one bank profile and business profile set up before connecting with Xero.

One-click Xero Integration from Marmin

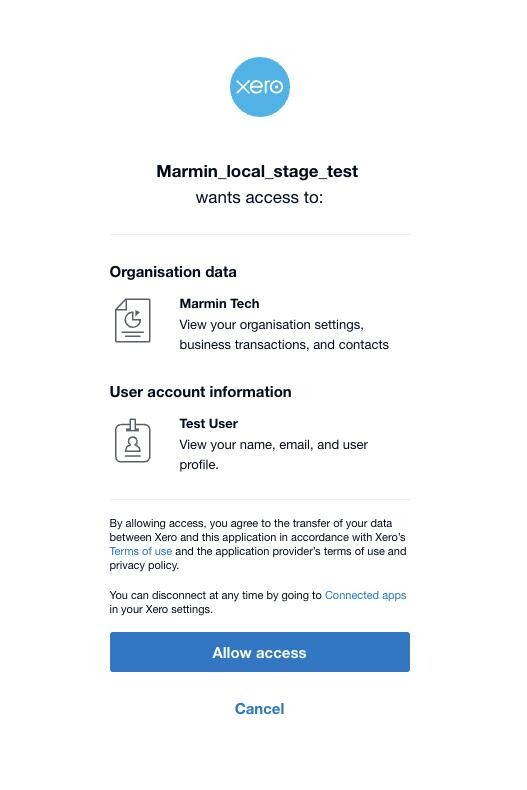

After selecting their business and bank details, users can initiate the integration with Xero by simply clicking on ‘Connect to Xero’. This action redirects users to the Xero platform to authorize the integration with Marmin.

Here, users must select the organization they wish to link with Marmin. By granting access, users agree to the secure transfer of data between Xero and Marmin per Xero’s Terms of Use and Privacy Policy. This prioritizes user privacy while ensuring compliance with data protection regulations. Once the organization is chosen in Xero, users are prompted to finalize the integration by clicking “Allow access”. Upon confirming this, the integration is done, and users receive confirmation of successful integration between Marmin and Xero.

Simplifying Customer and Invoice Creation with Marmin

Accuracy and efficiency are critical in the field of accounting and compliance. The process of creating customers and invoices is streamlined by Marmin’s integration with Xero, which also ensures smooth compliance with KSA regulations. Let us look more closely at how this integration makes it easier to create customers and invoices, as well as how users can efficiently control data flow and keep track of modifications.

Making invoices and customers with Marmin integrated with Xero is a simple process. Important information like email addresses, phone numbers, TAX IDs, and VAT numbers can be directly entered into Xero by users. These particulars guarantee adherence to regional laws and aid in accurate record-keeping. Users can access the data entered in Xero for additional processing and compliance checks in Marmin, where it flows seamlessly from there.

Users only need to enter invoice and customer information into Xero for the data to be automatically and instantly synced with Marmin. Through the user-friendly interface of Marmin, users can keep an eye on changes and track the status of their transactions. Real-time logs give users insight into the syncing process and make it possible to spot any potential problems or inconsistencies.

Marmin provides powerful error logging and management features in the event of errors or rejections during the synchronization process. Users are promptly notified through the platform if an invoice is rejected by ZATCA. Users can maintain the integrity of their financial records and guarantee compliance with regulatory requirements by promptly addressing errors.

Enhancing Xero with Marmin

Not only does Marmin integrate with Xero seamlessly, but it also improves the overall accounting experience by adding a sophisticated functional layer. Let us examine how Marmin’s extra features enhance Xero’s functionality and provide users the confidence to manage local compliance.

Marmin’s real-time logs give customers unmatched transparency and understanding of their e-invoicing procedures. With the help of these logs, users can monitor the status of credit notes, invoices, and customer creations in real-time, guaranteeing accuracy and compliance at every stage. Users are empowered to proactively detect and promptly address any issues or errors by having the ability to monitor transactions as they happen, thereby minimizing disruptions and guaranteeing seamless operations.

Marmin also supports several invoice categories, such as standard rates, zero-rated goods, and tax-exempt services. Users can create and manage invoices in full compliance with local regulations thanks to this extensive support. Additionally, by automating the matching of VAT transactions between the two platforms, Marmin’s integration with Xero streamlines VAT reconciliation. This lowers the possibility of mistakes while also saving important time that would be better used for analytical and strategic financial planning. Moreover, the ability to generate invoices straight from Marmin improves the user experience by reducing the number of system switches required during the invoicing process.

Users can integrate and forget about Marmin because the process is so easy to understand and seamless. Businesses can comply with e-invoicing regulations with ease thanks to the seamless integration—they will not even be aware that another platform is involved. Marmin’s robust features and intuitive design make it virtually invisible for businesses, allowing them to focus on their core operations without any interruptions or distractions. Its features range from data synchronization to compliance management.

Marmin is the best option for companies looking for smooth integration with Xero for e-invoicing compliance because it makes compliance as simple as breathing.

Reach out to us at hello@marmin.ai